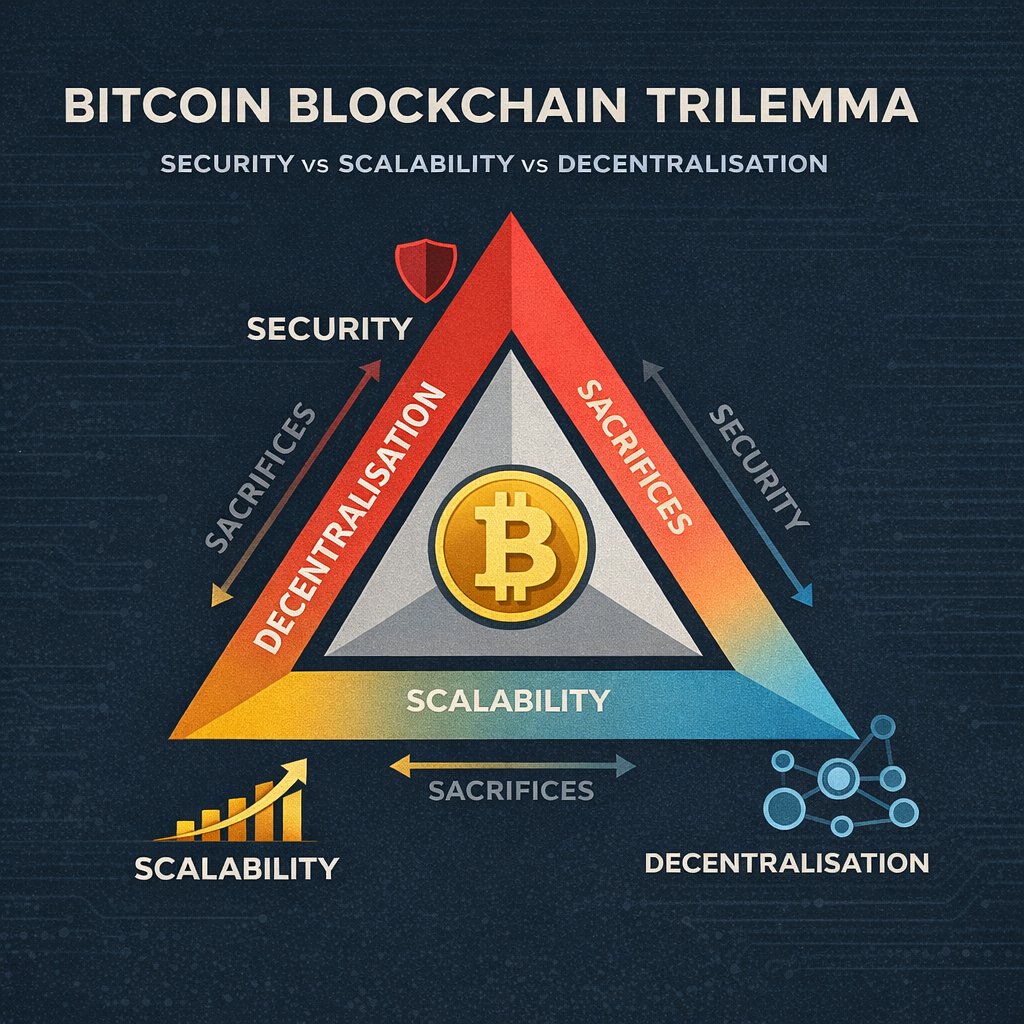

The Bitcoin Blockchain Trilemma: Security vs Scalability vs Decentralisation

The Bitcoin Blockchain Trilemma

Why Bitcoin deliberately chooses “slow and hard” over “fast and fragile”

Introduction

In blockchain engineering, few concepts are as fundamental or as misunderstood as the Blockchain Trilemma.

The trilemma states that a distributed ledger system can optimise for only two of the following three properties at any one time:

Security

Scalability

Decentralisation

Attempting to maximise all three simultaneously results in trade-offs that weaken at least one dimension.

Bitcoin’s design makes a clear, intentional choice:

Security and decentralisation come first. Scalability is secondary.

This is not a flaw it is a design philosophy rooted in cryptography, game theory, and adversarial threat modelling.

At BringBackMyCrypto.com, understanding this trilemma is essential when analysing:

Wallet security failures

Protocol limitations

Custodial risk

Layer-2 architectures

Why “faster blockchains” often sacrifice trustlessness

Why Bitcoin remains uniquely recoverable and auditable even after 15+ years

1. Defining the Trilemma Components

1.1 Security

In Bitcoin, security means:

Resistance to double-spending

Immutability of confirmed transactions

Economic cost to rewrite history

Resistance to censorship and protocol manipulation

Cryptographic soundness (ECDSA / Schnorr, SHA-256)

Robustness against state-level adversaries

Security is enforced through:

Proof-of-Work (PoW)

Global hash competition

Longest-chain consensus

Deterministic validation rules

Full-node verification

Security is non-negotiable. If Bitcoin becomes insecure, it becomes worthless.

1.2 Scalability

Scalability answers one question:

How many transactions per second can the network process without failure?

Bitcoin base layer characteristics:

~7 transactions per second

~10 minute block interval

~1–4 MB effective block size

Global propagation latency

This is intentionally constrained.

Bitcoin does not attempt Visa-scale throughput at Layer 1 because doing so would:

Increase hardware requirements

Reduce node participation

Centralise validation

Increase attack surface

Undermine self-sovereignty

1.3 Decentralisation

Decentralisation means:

Anyone can run a full validating node

No privileged validators

No central scheduler

No leader election cartel

No trusted third parties

Consensus enforced by users, not miners

Bitcoin decentralisation is expressed through:

Tens of thousands of independently operated nodes

Permissionless mining

Open-source consensus rules

Fork resistance through social consensus

Decentralisation is the enforcer of Bitcoin’s rules.

2. Why the Trilemma Exists (A Systems Perspective)

The trilemma arises due to physical and economic constraints, not ideology.

Bandwidth Constraint

Every full node must:

Receive blocks

Verify scripts

Validate signatures

Store the full chain

Increasing throughput increases:

Bandwidth usage

Disk requirements

CPU load

Memory pressure

This excludes users with modest hardware leading to centralisation.

Latency Constraint

Bitcoin is global.

Propagation delay between continents is measured in hundreds of milliseconds.

Large blocks increase orphan risk and incentivise:

Mining pools

Block relay cartels

Private mempools

Game-Theoretic Constraint

If validation becomes expensive:

Users outsource verification

Custodians emerge

“Trust me” replaces “verify”

This is how decentralisation dies.

3. Bitcoin’s Explicit Trilemma Choice

Bitcoin optimises for:

✅ Security

✅ Decentralisation

❌ Base-layer Scalability

This is not accidental.

Satoshi Nakamoto’s design ensures that:

Verification is cheap

Attack is expensive

Consensus rules are rigid

History is extremely costly to rewrite

Bitcoin treats Layer 1 as a settlement layer, not a retail payment rail.

4. Proof-of-Work: Why Security Is Expensive on Purpose

Bitcoin security is backed by real-world energy.

Proof-of-Work provides:

Objective cost

Unforgeable history

Externalised attack expense

Resistance to “cheap consensus”

To attack Bitcoin, an adversary must:

Acquire massive hashing power

Sustain it for long durations

Compete against honest miners

Lose money continuously

Be visible in real time

This makes large-scale attacks economically irrational.

5. Scalability Without Sacrificing the Base Layer

Bitcoin scales vertically and off-chain, not by bloating Layer 1.

Layer-2 Solutions

Lightning Network

State channels

Sidechains

Ark

Fedimint (trade-off aware)

Key principle:

Do not change Layer-1 trust assumptions

Layer-2 systems inherit Bitcoin’s security only if users can exit unilaterally.

6. The Trilemma and Wallet Recovery

From a recovery and forensic perspective, Bitcoin’s trilemma choice is a feature.

Because Bitcoin is:

Deterministic

Auditable

Non-mutable

Fully verifiable

We can:

Reconstruct wallet histories

Validate old UTXOs

Interpret legacy scripts

Recover funds decades later

Analyse time-locked outputs

Decode partially signed transactions

This is not possible on opaque, mutable, or centrally governed ledgers.

Bitcoin’s “slow” design is why recovery remains possible long after keys are lost.

7. Why Bitcoin Refuses to “Optimise” the Trilemma Away

The trilemma cannot be solved it can only be balanced.

Bitcoin chooses:

Fewer transactions

Higher assurance

Maximum auditability

Minimal trust

Every proposal that claims to “fix” Bitcoin by increasing throughput must answer one question:

Who loses the ability to independently verify?

If the answer is:

Users

Home nodes

Non-custodial wallets

Then Bitcoin has already lost.

8. Summary: Bitcoin’s Trilemma in One Sentence

Bitcoin sacrifices base-layer speed so that anyone, anywhere, can independently verify the entire monetary system without permission.

That is the trade-off.

That is the point.

Final Thoughts

Bitcoin’s blockchain trilemma is not a limitation it is a security boundary.

It ensures that:

Funds cannot be frozen

History cannot be rewritten

Validation cannot be outsourced

Recovery remains possible

Sovereignty is preserved

At BringBackMyCrypto.com, we work with Bitcoin precisely because it refuses to compromise on these fundamentals.

If you are interacting with Bitcoin systems whether for storage, inheritance, recovery, or protocol research understanding the trilemma is essential.